Retirement planning in 2024 continues to evolve as individuals seek financial independence and stability in a rapidly changing economic landscape. The combination of longer life expectancy, healthcare challenges, and digital transformation has reshaped how people prepare for their later years. Rather than relying solely on pensions or traditional savings, retirement planning today emphasizes flexibility, education, and adaptability.

Technology as a Planning Tool

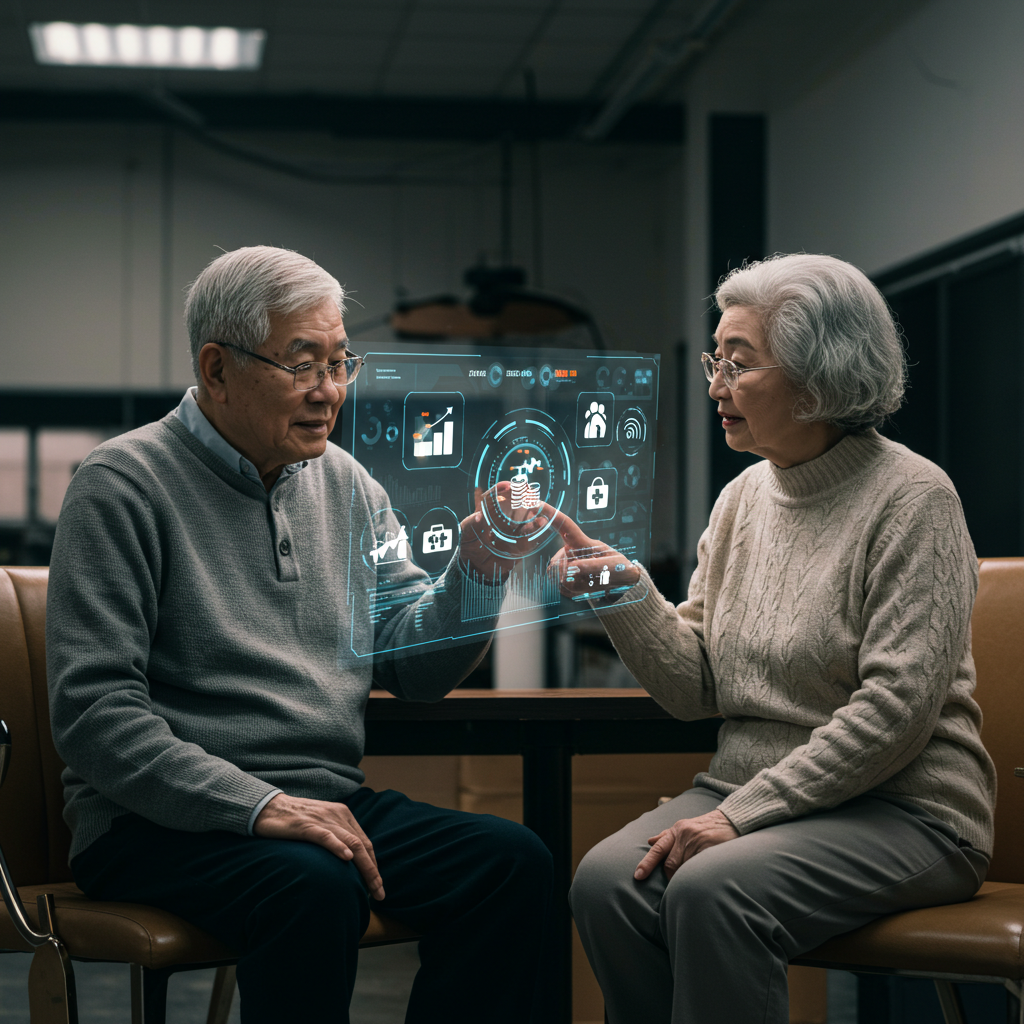

Digital platforms and mobile applications are now central to retirement strategies. Individuals can forecast expenses, simulate financial scenarios, and track their savings progress in real time. Artificial intelligence provides personalized insights, helping users adjust contributions or spending habits to achieve long-term goals. These tools make retirement planning more accessible and transparent.

Savings and Investment Diversification

Diversification remains a cornerstone of retirement security. In 2024, retirees and savers rely on a mix of pensions, employer-sponsored accounts, and diversified investment portfolios. Inflation-protected securities, global equities, and sustainable funds are increasingly included to balance growth with stability. This approach reduces exposure to risk while strengthening financial resilience.

Healthcare and Longevity

Healthcare is one of the most pressing concerns in retirement planning. With people living longer, the cost of medical care can significantly impact financial security. Many strategies now integrate health savings accounts, insurance solutions, and wellness-focused programs to ensure access to quality care without depleting retirement funds.

Financial Education and Awareness

Awareness plays a vital role in modern retirement planning. Individuals are encouraged to understand tax implications, optimize employer benefits, and recognize the importance of early preparation. Education reduces uncertainty and empowers people to make informed choices that align with both personal goals and broader economic realities.

Conclusions

Retirement planning in 2024 reflects a future-oriented approach shaped by technology, diversification, and health considerations. While uncertainties remain in global markets and life expectancy trends, proactive strategies and greater access to digital tools allow individuals to secure their financial independence. Ultimately, careful preparation ensures a stable and confident transition into retirement.