Retirement planning in 2024 has become increasingly complex, shaped by longer life expectancies, evolving financial products, and global economic shifts. For individuals and families, the ability to secure financial stability in later years requires careful preparation, diversified savings strategies, and an awareness of emerging retirement trends.

The Importance of Early Preparation

One of the most significant factors in retirement planning is time. Starting early allows for the compounding of savings and investments, creating stronger financial foundations. In 2024, financial advisors highlight the importance of building emergency funds, contributing consistently to retirement accounts, and regularly adjusting strategies as market conditions evolve.

The Role of Pensions and Social Security

Traditional pensions and government-provided social security remain critical components of retirement income. However, due to demographic pressures and shifting policy priorities, many countries are reassessing the sustainability of these systems. Individuals are encouraged to understand the eligibility requirements, projected benefits, and potential reforms that may influence their retirement planning decisions.

Expanding Investment Options

Beyond traditional pension funds, individuals in 2024 are exploring diversified investments to support retirement goals. These include exchange-traded funds (ETFs), dividend-focused equities, and fixed-income securities. Additionally, the rise of digital financial platforms has made access to global markets easier, enabling retirees to balance risk and reward across different asset classes.

Healthcare and Insurance Considerations

Healthcare costs remain a major factor influencing retirement planning. Insurance products, including long-term care coverage and comprehensive health policies, are increasingly vital for managing expenses later in life. By incorporating healthcare planning into overall retirement strategies, individuals can reduce financial uncertainty and protect assets.

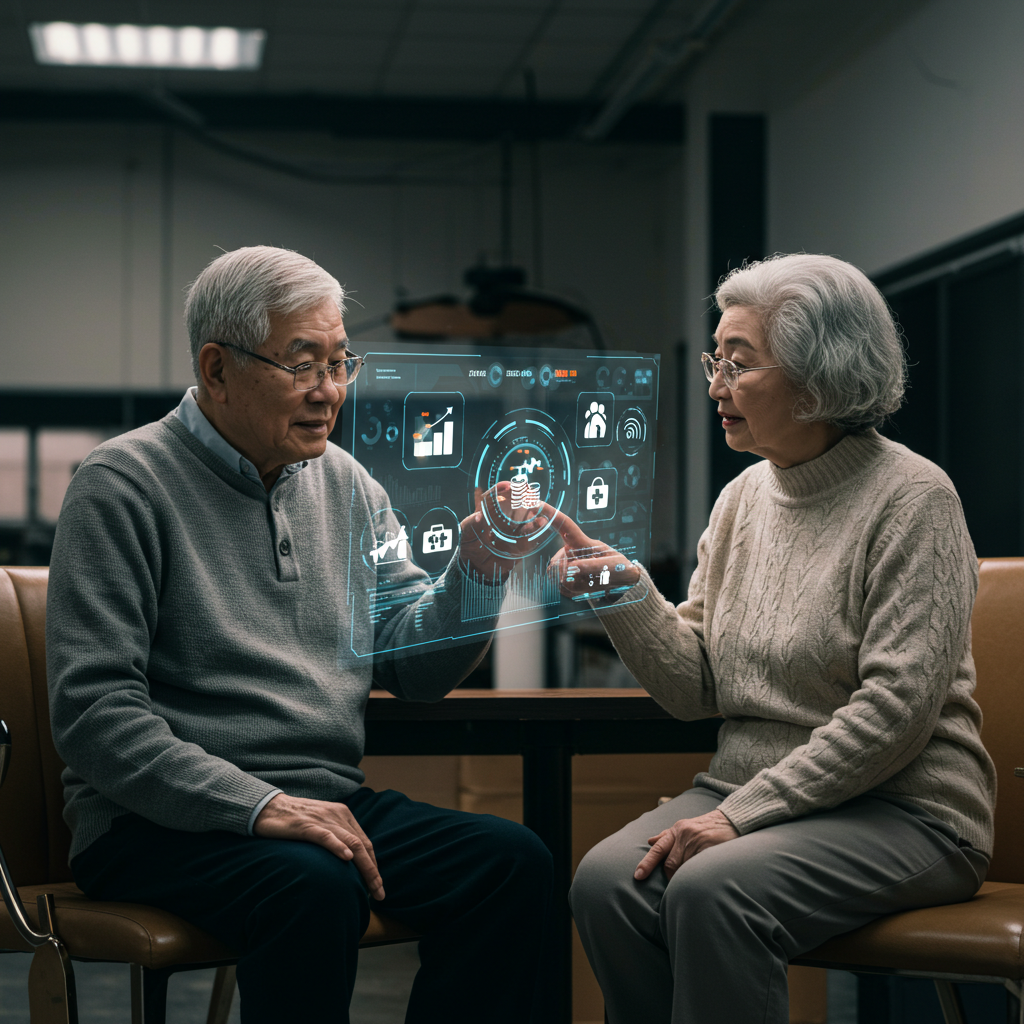

The Role of Technology in Retirement Planning

Digital platforms and financial planning tools are transforming retirement preparation. Robo-advisors, AI-driven forecasting, and online calculators allow individuals to model different scenarios, assess savings gaps, and receive tailored strategies. In 2024, technology serves as both an educational resource and a decision-making guide for building retirement security.

Conclusions

Retirement planning in 2024 reflects a dynamic balance between traditional approaches and modern innovations. While pensions and social security remain pillars of support, diversified investments, insurance planning, and technological tools play increasingly important roles. Individuals who begin early, adapt to evolving conditions, and take advantage of available resources will be better positioned to achieve financial independence in retirement.