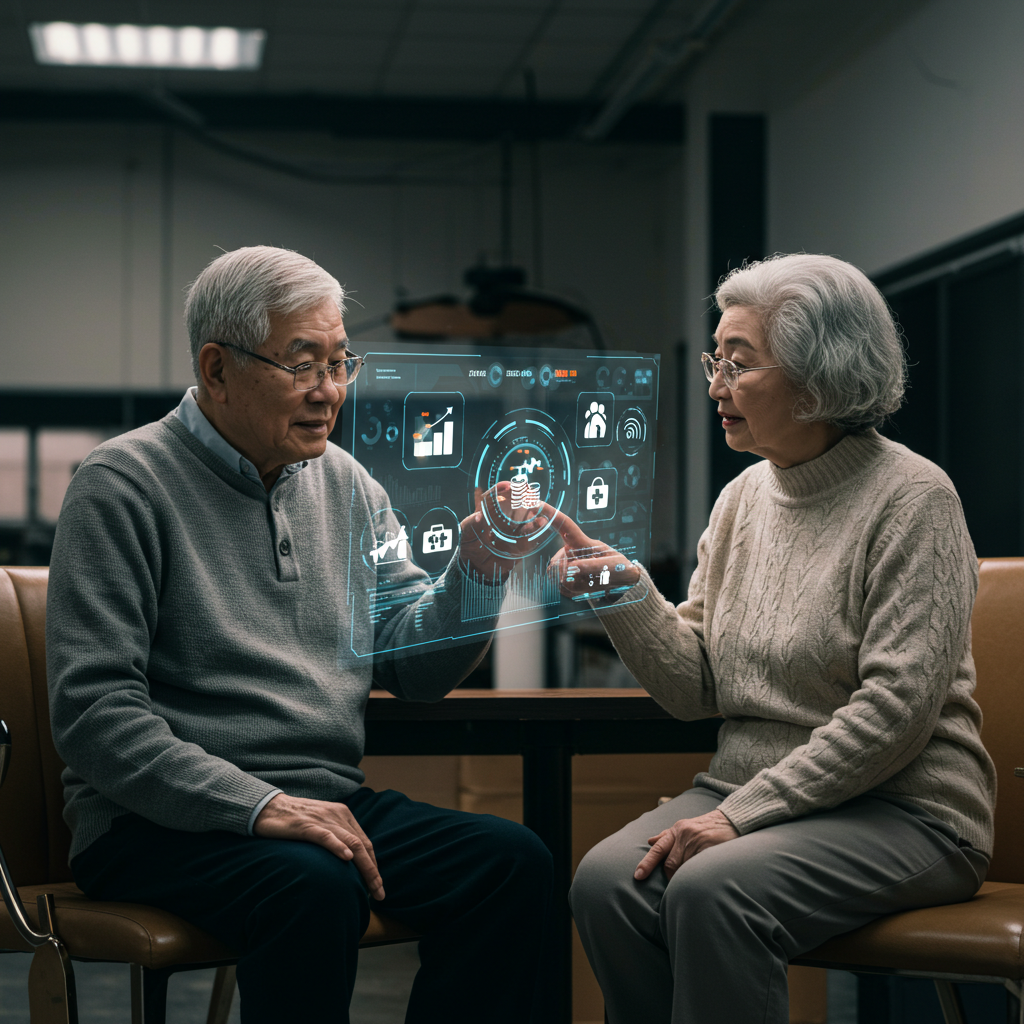

Understanding Retirement Planning in 2025 – Key Insights for the Future

Retirement planning in 2025 reflects the growing complexity of global financial systems, healthcare costs, and evolving lifestyle expectations. Individuals are increasingly aware of the importance of preparing early to ensure financial independence in later years. While traditional strategies such as pensions and savings accounts remain relevant, technological innovations and demographic shifts are influencing how people…