Retirement planning in 2023 has become more important than ever as people face longer life expectancy, rising healthcare costs, and shifting pension systems. Preparing for the future requires thoughtful strategies that balance saving, investing, and protection. With access to digital tools and increased financial education, individuals are better equipped to create sustainable retirement plans that provide independence and stability.

Why Retirement Planning Matters

Effective retirement planning ensures financial freedom in later years, reducing reliance on government programs or family support. It provides peace of mind, allowing individuals to focus on personal goals, hobbies, and family relationships while maintaining financial security throughout retirement.

Key Components of Retirement Planning in 2023

Savings and Contributions

Consistent savings remain the foundation of retirement readiness. Automatic payroll contributions, employer-sponsored plans, and individual retirement accounts play a central role in building wealth over time.

Pension Systems

In many regions, pension systems are being restructured to address demographic pressures. Public pensions provide a base, while private plans offer flexibility and additional opportunities for growth.

Investment Diversification

Diversified investments across equities, bonds, real estate, and alternative assets help mitigate risks and support steady growth. In 2023, balancing security with growth potential remains essential.

Healthcare and Insurance

Healthcare costs continue to rise, making insurance a vital part of retirement planning. Long-term care policies and health coverage reduce the risk of financial strain caused by medical expenses.

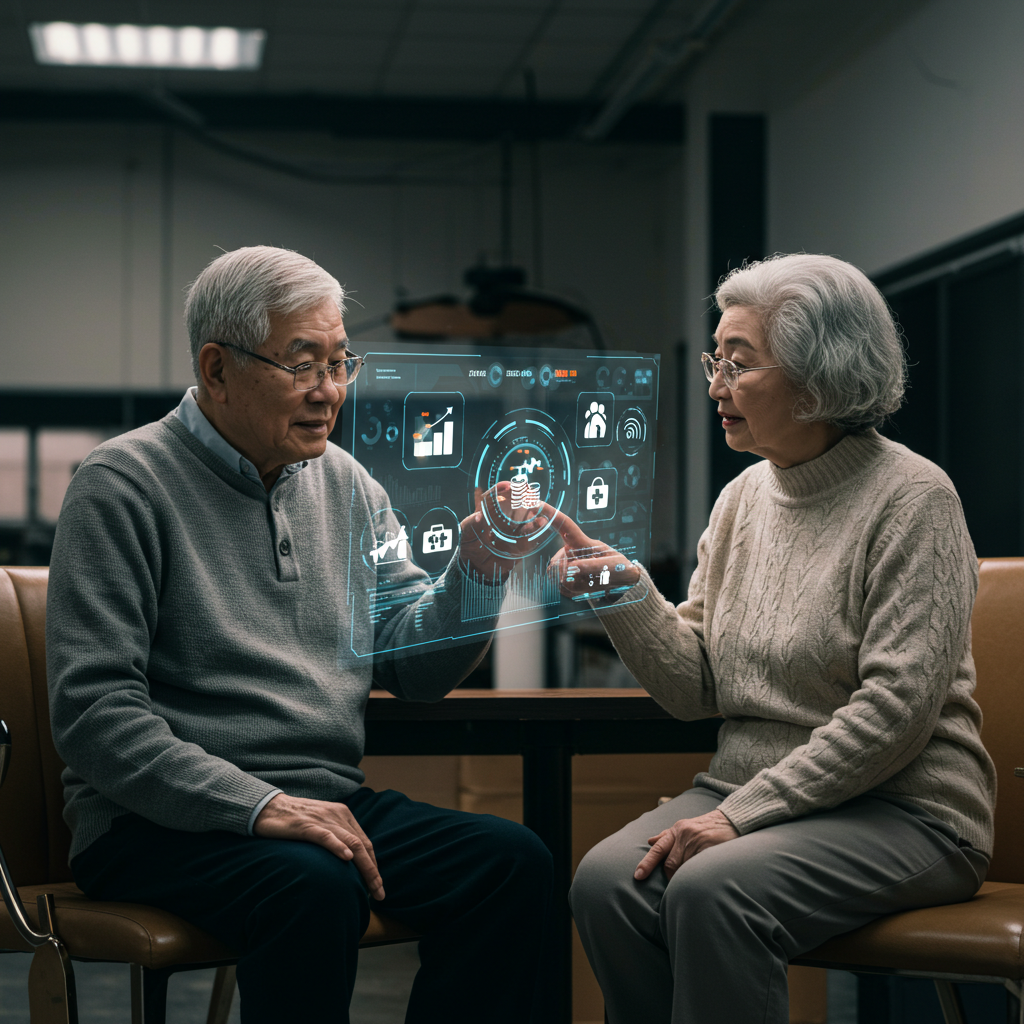

Technology and Digital Tools

Digital platforms and retirement calculators enable individuals to model future scenarios and track progress. Artificial intelligence is increasingly used to personalize strategies and forecast long-term expenses.

Challenges in 2023

Retirement planning faces challenges such as inflation, volatile markets, and uncertain employment conditions. Longevity risk—the possibility of outliving one’s savings—remains a primary concern, requiring careful financial preparation and disciplined contributions.

Benefits of a Strong Retirement Plan

A well-structured retirement plan ensures independence, financial security, and resilience against unexpected costs. It allows retirees to maintain their lifestyle and focus on well-being without financial stress.

Conclusions

Retirement planning in 2023 emphasizes adaptability and foresight. Savings, pensions, investments, and healthcare considerations all form the foundation of a secure future. Technology supports more personalized planning, but long-term discipline remains essential. By addressing modern challenges and leveraging available tools, individuals can build financial independence and enjoy stability throughout their retirement years.