Retirement planning in 2024 remains a central topic in personal finance, as individuals aim to balance short-term needs with long-term stability. With advances in technology, shifts in global economies, and evolving demographic trends, the concept of retirement is no longer limited to traditional savings methods. Instead, it incorporates flexible strategies designed to adapt to uncertainty and provide lasting security.

The Role of Technology in Retirement Planning

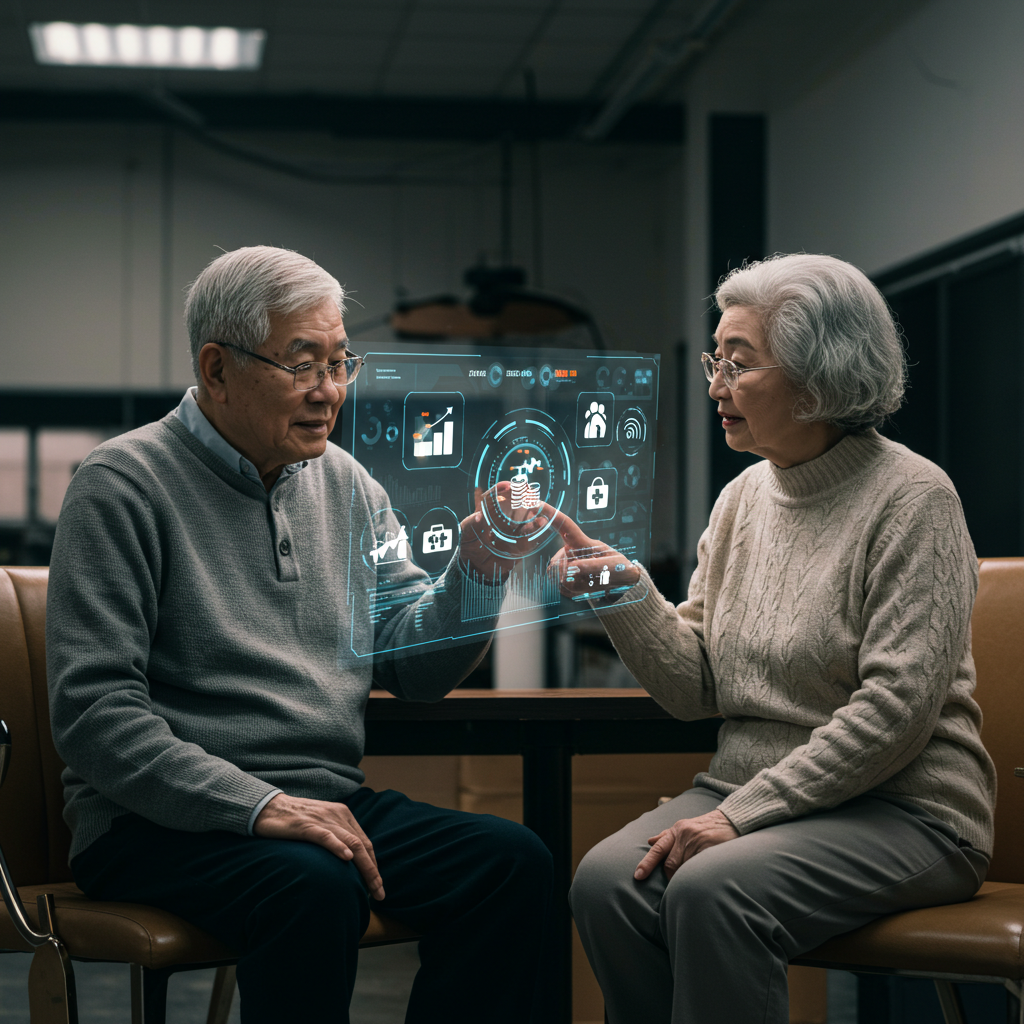

Digital tools are reshaping how individuals plan for retirement. Online platforms now allow people to track expenses, forecast future needs, and simulate different retirement scenarios. Artificial intelligence provides personalized recommendations, while mobile apps help individuals remain consistent with contributions and budget goals. This accessibility enhances financial literacy and empowers better decision-making.

Savings and Investment Strategies

In 2024, diversification remains a critical principle for retirement savings. Traditional vehicles like pensions and employer-sponsored plans coexist with investment accounts tailored to individual risk profiles. Some retirees also include exposure to global markets or inflation-protected securities to maintain stability over time. This mix of approaches demonstrates how flexibility is essential when building a reliable safety net.

Healthcare and Longevity Considerations

Healthcare costs are an increasingly important factor in retirement planning. With people living longer, ensuring access to medical care and long-term support has become a priority. Insurance solutions and health savings accounts are often integrated into retirement strategies to protect against unexpected expenses, ensuring financial independence during later years.

The Importance of Education and Awareness

A key element in 2024 is the emphasis on financial education. Individuals are encouraged to learn about tax advantages, insurance products, and investment diversification. This knowledge reduces reliance on uncertain assumptions and equips retirees with tools to adapt their plans as economic and personal circumstances evolve.

Conclusions

Retirement planning in 2024 reflects a blend of innovation, education, and adaptability. By leveraging digital tools, incorporating diverse strategies, and addressing healthcare concerns, individuals can strengthen their financial independence. While uncertainties in markets and life expectancy remain, careful preparation ensures a more stable and secure retirement future.