Retirement planning in 2025 reflects the increasing complexity of modern financial systems, healthcare demands, and longer life expectancy. Individuals and families are facing new challenges and opportunities as they prepare for a secure financial future. Understanding key strategies is essential to developing resilience against economic uncertainty and evolving social needs.

Shifts in Pension Systems

Many regions are rethinking traditional pension structures due to demographic changes and fiscal pressures. In 2025, hybrid models combining public pensions with private retirement accounts are gaining attention. These approaches aim to balance sustainability with individual choice, reflecting the diverse financial realities of global populations.

The Role of Personal Savings

Personal savings remain a cornerstone of retirement planning. In 2025, households are increasingly diversifying between traditional savings accounts, long-term investments, and tax-advantaged retirement plans. The focus is not only on accumulating wealth but also on preserving purchasing power amid inflationary pressures.

Healthcare and Longevity Considerations

Healthcare costs continue to rise worldwide, making them a critical factor in retirement planning. Longer life expectancy requires more detailed financial forecasting, ensuring resources are available for medical needs, long-term care, and quality of life. In 2025, integrating healthcare planning with retirement strategies has become a central theme for financial security.

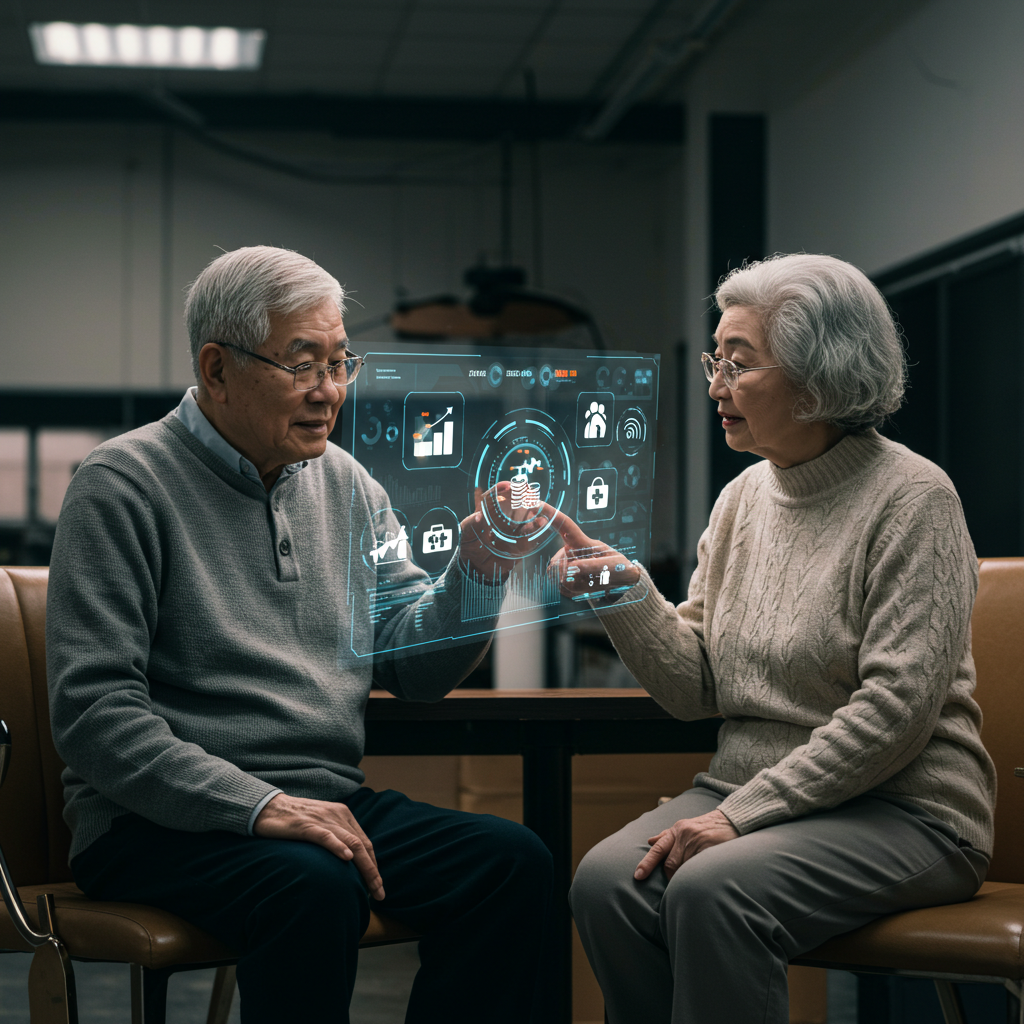

Technology and Retirement Solutions

Technological advancements are reshaping how retirement planning is approached. Digital platforms, robo-advisors, and AI-driven forecasting tools provide individuals with access to professional-grade financial insights. This shift enhances accessibility, helping users create adaptable strategies that can evolve with market conditions and personal circumstances.

Conclusions

Retirement planning in 2025 emphasizes adaptability, foresight, and resilience. Shifts in pension systems, the importance of diversified personal savings, the rising cost of healthcare, and the integration of technology all shape how individuals prepare for their financial future. By analyzing these elements, readers can gain a deeper understanding of how modern retirement planning strategies align with long-term security in a complex and changing world.