Retirement planning in 2025 reflects the growing complexity of global financial systems, healthcare costs, and evolving lifestyle expectations. Individuals are increasingly aware of the importance of preparing early to ensure financial independence in later years. While traditional strategies such as pensions and savings accounts remain relevant, technological innovations and demographic shifts are influencing how people approach retirement security.

The Importance of Early Preparation

Starting retirement planning early continues to be a critical factor for building long-term financial stability. By gradually accumulating savings, individuals benefit from compound growth and reduced reliance on last-minute adjustments. In 2025, this principle remains unchanged, highlighting the value of consistent contributions over time.

Healthcare and Longevity Considerations

As life expectancy rises, healthcare costs represent a central concern in retirement planning. Planning for medical expenses, long-term care, and insurance coverage is increasingly prioritized. Individuals recognize that financial stability in retirement requires more than income—it demands preparation for evolving health needs.

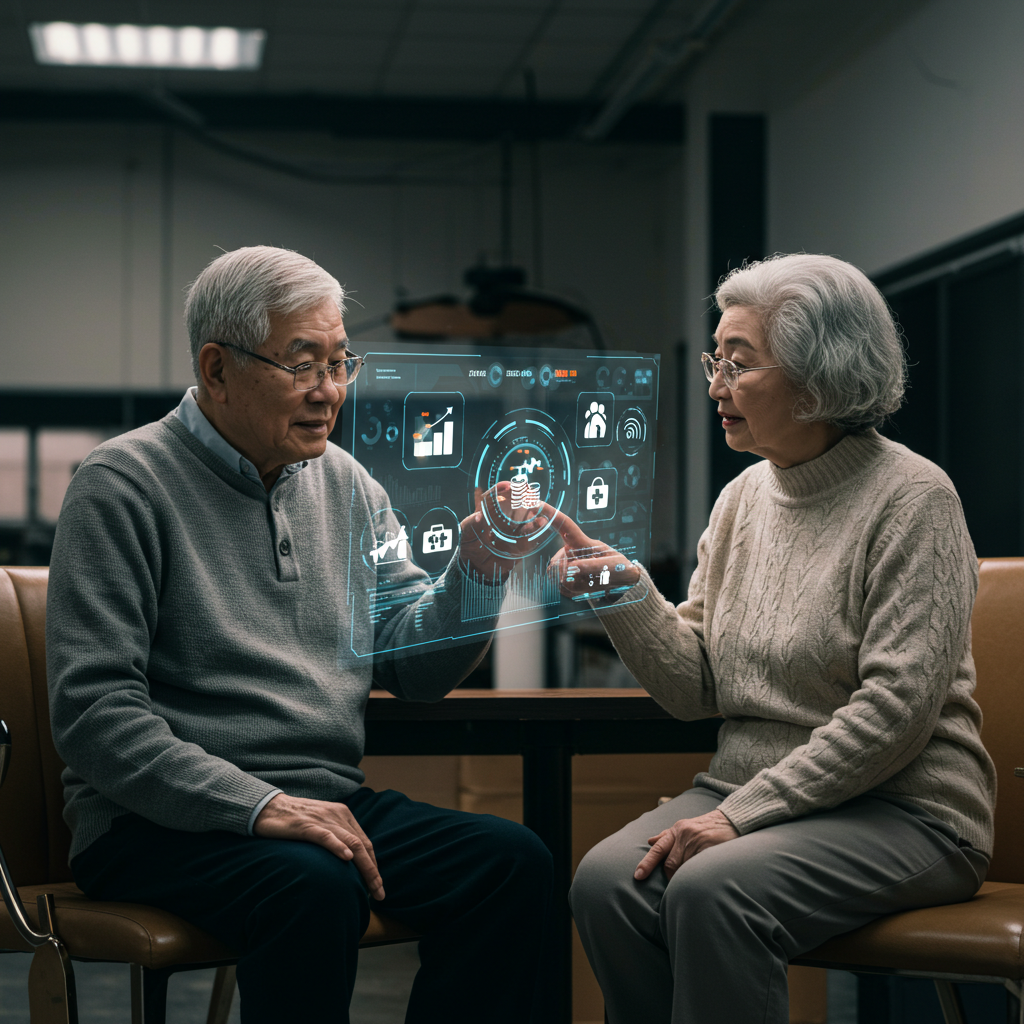

Role of Technology in Retirement Planning

Digital tools have transformed how people plan for the future. AI-driven financial advisors, mobile applications, and retirement calculators provide real-time projections and personalized guidance. These technologies allow individuals to simulate scenarios, adjust strategies, and make informed decisions aligned with personal goals.

Diversification of Retirement Assets

Relying solely on pensions or government support is becoming less common. Retirement planning in 2025 emphasizes diversified assets such as investment accounts, insurance products, and real estate. This mix helps individuals mitigate risks while ensuring multiple income streams during retirement years.

Global Economic Influences

Global trends such as inflation, regulatory reforms, and market volatility also shape retirement strategies. Individuals are more cautious about ensuring their plans remain adaptable to unexpected changes. Resilience and flexibility are essential traits in constructing a retirement framework that can withstand shifting conditions.

Conclusions

Retirement planning in 2025 is a multifaceted process that balances traditional methods with modern innovations. By preparing early, considering healthcare, using digital tools, and diversifying assets, individuals can secure greater stability in later life. While challenges remain, those who prioritize long-term planning are better positioned to maintain independence and financial security in retirement.